How to Insert Existing Quiz into Courses in e-LATiH Corporate Access

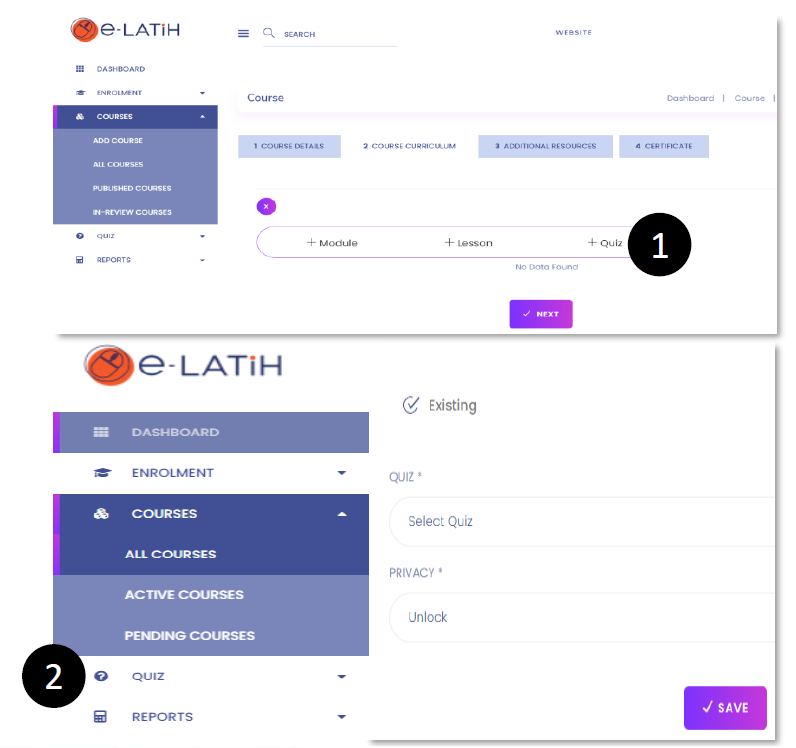

Step 1: Insert the quiz as part of the content, by clicking the “Quiz” tab . You can select an existing quiz that has been created.

Step 2: Create a new quiz from the Quiz tab.

Related Articles

How To Enroll for e-LATiH Courses

Courses 1. How do I enrol in e-LATiH courses? The platform is intuitive. You can easily select and enrol in any course you are interested in by clicking “Enrol Now” button on the course page. 2. What types of courses are offered on e-LATiH? All ...Steps For e-Tris Authentication - E-LATiH Corporate Access

Step 1: Click Corporate Tab Step 2: Enter company MyCOID / Registration Number as per registration in the e-Tris should you encounter any issue i.e. MYCOID not found or error, kindly procced to email to helpdesk@hrdcorp.gov.my and attached the ...e-LATiH Corporate Access

Submit the interest form in https://elatih.hrdcorp.gov.my/interest-form Submit the CRF to elatih@hrdcorp.gov.my . You can download the Corporate Access Request Form in the attachment below. Enjoy the e-LATiH. For more details of e-LATiH Corporate ...How to Claim for e-LATiH Premium Courses

Grant Application I. Apply grant by selecting Skim Bantuan Latihan (SBL) from the Scheme Code. II. Under the “Programme Details" tab, it is mandatory to state "e-LATiH Premium" as the description of the course. III. Insert the screenshot of the ...HRD Corp e-LATiH - FAQs

HRD Corp e-LATiH 1. What is e-LATiH? e-LATiH is HRD Corp’s e-learning learning platform that provides Malaysians with unlimited access to online courses from reputable content providers. 2. Who is eligible for e-LATiH? e-LATiH is open to all ...

Popular Articles

Levy Calculation Guideline

Section 2 of the PSMB Act 2001 Employee Any citizen of Malaysia who is employed for wages under a contract of service (under full-time employment whether contract or permanent staff) with an employer, but does not include any domestic servant. If the ...E-Disbursement Application

• Introduced to employers and training providers in 2003. • Reimbursement of training grants through direct credit to employer’s bank account. • A secure and fast method of payment. • A solution for unpresented cheques to employers. • Training grant ...Guidelines for Generated Attendance Report

Must be retrieved from the online training platform system Must show each of trainee’s complete name, training date, log-in and log-out times, or total duration of training Must be signed by both training provider and employer with person’s name, ...Levy Forfeiture

Section 25 of the PSMB Act 2001 If an employer does not make any claims against the Fund within such period as may be determined by the Board from the date of its registration with the Corporation or from the date of the last financial assistance or ...Levy Arrears - Form 3 Schedule of Arrears

Employer circular 08/2015 - Employers have to fill up form 3 before make payment for arrears payment. The process days will take 5 working days and will notify through the “inbox” in Etris System. NOTE: please check Form 3 status is ...